Key Points

-

Research suggests that since the 1980s, regular workers’ incomes have largely stagnated, while higher-level salaries, especially for executives, have grown dramatically, with CEO pay increasing over 1,000% compared to modest gains for typical workers.

-

It seems likely that regular workers have seen a decline in traditional benefits like pensions, shifting to less secure options, while higher-level employees likely enjoy more comprehensive benefits, including supplemental retirement plans and perks.

Income Comparison

Since the 1980s, regular workers’ wages have barely budged when adjusted for inflation. For example, by 2018, median household income was no higher than in 2000, indicating a 15-year stagnation period. In contrast, executive compensation, particularly for CEOs, has soared, with pay increasing by 1,209.2% from 1978 to 2022, while typical workers’ pay rose only 15.3% over the same period. By 2020, CEOs earned 351 times more than typical workers, up from 61-to-1 in 1989.

Benefits Comparison

For regular workers, benefits like defined benefit pensions have declined, with only 5% of organizations offering them to new hires by 2020, down from 48% in 2000. Health insurance coverage also dropped, from 62% in 1980 to 51% in 2013. Higher-level employees, however, likely have access to better benefits, such as supplemental executive retirement plans (SERPs) and enhanced health insurance, with 44% of management workers having access to Health Savings Accounts in 2018 compared to 11% of service workers.

Survey Note: Detailed Analysis of Income and Benefits Trends Since the 1980s

This note provides a comprehensive analysis of the trends in income and benefits for regular workers compared to higher-level employees, particularly executives, since the 1980s. The data is drawn from various economic reports, including those from the Economic Policy Institute (EPI), Bureau of Labor Statistics (BLS), Pew Research Center, and other reputable sources, to ensure a thorough understanding of the divergence over time.

Income Trends: Regular Workers vs. Higher-Level Employees

Regular Workers’ Income:

-

Since the 1980s, research indicates that the income of regular workers, often represented by middle-wage or production/nonsupervisory workers, has experienced significant stagnation. For instance, from 1979 to 2013, the cumulative change in real hourly wages for middle-wage workers (50th percentile) was only about 5.1% by 2000, and it has remained largely stagnant since then. This is evident from Pew Research Center data, which shows that by 2018, the median household income was no higher than it was in 2000, marking a 15-year period of stagnation [Pew Research Center, 2018, https://www.pewresearch.org/short-reads/2018/08/07/for-most-us-workers-real-wages-have-barely-budged-for-decades/].

-

Adjusted for inflation, the average hourly wage for most U.S. workers has had about the same purchasing power as it did in 1978, with most wage gains flowing to the highest earners [Pew Research Center, 2018, https://www.pewresearch.org/short-reads/2018/08/07/for-most-us-workers-real-wages-have-barely-budged-for-decades/].

-

Specific figures from EPI reports highlight that from 1978 to 2023, the pay of typical workers (production/nonsupervisory workers) increased by only 15.3% to 24%, depending on the measure used, reflecting a slow growth rate [EPI, 2024, https://www.epi.org/publication/ceo-pay-in-2023/].

Higher-Level Employees’ (Executives) Income:

-

In contrast, the compensation of higher-level employees, particularly CEOs and executives, has grown dramatically since the 1980s. EPI reports consistently show that CEO pay has soared, with a 1,209.2% increase from 1978 to 2022, while typical workers’ pay rose only 15.3% over the same period [EPI, 2023, https://www.epi.org/publication/ceo-pay-in-2022/]. Another report from 2019 notes a 940% increase since 1978, compared to 12% for typical workers [EPI, 2019, https://www.epi.org/publication/ceo-compensation-2018/].

-

By 2020, the ratio of CEO-to-typical-worker compensation was 351-to-1 under the realized measure, up from 61-to-1 in 1989 and 21-to-1 in 1965, highlighting the widening gap [EPI, 2021, https://www.epi.org/publication/ceo-pay-in-2020/]. This trend is supported by Forbes, which reported a 1,085% increase in CEO compensation from 1978 to 2023, while typical workers’ earnings rose by only 24% [Forbes, 2024, https://www.forbes.com/sites/jackkelly/2024/12/27/the-meteoric-rise-in-ceo-compensation-how-executive-pay-surged-over-1000-since-1978/].

-

This growth is not tied to individual productivity or company performance but rather to broader market trends and executives’ bargaining power, raising concerns about income inequality [EPI, 2024, https://www.epi.org/publication/ceo-pay-in-2023/].

Comparison Table: Income Growth Since 1978:

| Group | Growth Rate (1978–2023) | Notes |

|———————–|————————-|———————————————————————-|

| Regular Workers | 15.3%–24% | Stagnant real wages, adjusted for inflation, with most gains at the top. |

| CEOs/Executives | 940%–1,209.2% | Driven by stock options, bonuses, and market trends, far outpacing workers. |

Benefits Trends: Regular Workers vs. Higher-Level Employees

Regular Workers’ Benefits:

-

Since the 1980s, there has been a notable shift in retirement benefits for regular workers. Defined benefit (DB) pension plans, once common, have declined significantly. Workplace Consultants data indicates that in the 1980s, 45% of private sector workers were covered by pension plans, but by 2016, only 33% of those with workplace retirement plans had a pension, down from 88% historically [Workplace Consultants, https://workplaceconsultants.net/commentary/retirementtsunami/the-history-of-benefits/]. By 2020, only 5% of organizations offered DB plans to new hires, down from 48% in 2000, according to WTW [WTW, 2024, https://www.wtwco.com/en-us/insights/2024/04/shifts-in-benefit-allocations-among-us-employers-2000-2020].

-

This shift to defined contribution (DC) plans like 401(k)s places more responsibility on employees for retirement savings, with employer contributions often cut in half when switching plans. The BLS reports that by 2018, 64% of workers had access to DC plans, with participation at 47%, compared to 17% access and 13% participation for DB plans [BLS, 2019, https://www.bls.gov/opub/btn/volume-8/compensation-trends-into-the-21st-century.htm].

-

Health insurance coverage has also declined. Pew Research Center data shows that the share of workers covered by their own employer’s health plan dropped from 62% in 1980 to 51% in 2013, with overall employer-sponsored coverage falling from 77% to 69% over the same period [Pew Research Center, 2016, https://www.pewresearch.org/social-trends/2016/10/06/1-changes-in-the-american-workplace/].

-

Total benefit costs as a percentage of pay increased from 14.9% in 2000 to 19.4% in 2020, largely driven by rising healthcare costs, while retirement benefits decreased from 9.0% to 7.1% of pay, reflecting the shift from DB to DC plans [WTW, 2024, https://www.wtwco.com/en-us/insights/2024/04/shifts-in-benefit-allocations-among-us-employers-2000-2020].

Higher-Level Employees’ (Executives) Benefits:

-

Higher-level employees, including executives, generally have access to more comprehensive and flexible benefits compared to regular workers. While specific historical data is limited, it is implied that executives have benefited from trends like personalization and innovation in benefits. For example, in 2018, 44% of management, professional, and related workers had access to Health Savings Accounts (HSAs), compared to only 11% of service workers, suggesting better access for higher-level employees [BLS, 2019, https://www.bls.gov/opub/btn/volume-8/compensation-trends-into-the-21st-century.htm].

-

Executives often have access to supplemental executive retirement plans (SERPs), which are defined benefit plans tailored for high-level employees and not subject to the same regulatory constraints as traditional pensions. This allows for higher benefits, as noted in various compensation reports [Workplace Consultants, https://workplaceconsultants.net/commentary/retirementtsunami/the-history-of-benefits/].

-

Access to retirement plans is also higher for executives. In 2018, 80% of management, professional, and related workers had access to defined contribution plans, with 67% participation, compared to 41% access and 22% participation for service workers. For defined benefit plans, 24% of higher-level workers had access, compared to 10% for service workers [BLS, 2019, https://www.bls.gov/opub/btn/volume-8/compensation-trends-into-the-21st-century.htm].

-

Executives may also receive additional perks such as company cars, club memberships, relocation assistance, and post-retirement benefits, which are less common for regular workers. Health insurance plans for executives are likely more robust, with lower out-of-pocket costs and higher coverage rates, though specific historical data is sparse.

Comparison Table: Benefits Access in 2018 (Example for Recent Trends):

| Benefit Type | Regular Workers (Service, %) | Higher-Level Workers (Management, %) |

|—————————-|——————————|————————————–|

| HSA Access | 11 | 44 |

| Defined Contribution Access| 41 | 80 |

| Defined Benefit Access | 10 | 24 |

Factors Contributing to the Divergence

-

Policy and Economic Changes: The 1980s marked a shift in economic policies that favored deregulation, globalization, and reduced union power, contributing to wage stagnation for regular workers while allowing executive pay to soar. Laws like the Pension Protection Act of 2006 accelerated the decline of defined benefit pensions for regular workers, while executives often have access to unregulated supplemental plans [Workplace Consultants, https://workplaceconsultants.net/commentary/retirementtsunami/the-history-of-benefits/].

-

Bargaining Power: Executives, particularly CEOs, have significant bargaining power due to their role in setting their own compensation, leading to packages heavily tied to stock options and bonuses. Regular workers, on the other hand, have less bargaining power, especially with the decline of unions and the shift to a more competitive labor market [EPI, 2024, https://www.epi.org/publication/ceo-pay-in-2023/].

-

Technological and Market Trends: Technological advancements and globalization have increased the demand for highly skilled workers, further widening the income gap, while executives benefit from stock market gains and market power [Forbes, 2024, https://www.forbes.com/sites/jackkelly/2024/12/27/the-meteoric-rise-in-ceo-compensation-how-executive-pay-surged-over-1000-since-1978/].

Conclusion

Since the 1980s, there has been a stark contrast between the income and benefits of regular workers and higher-level employees:

-

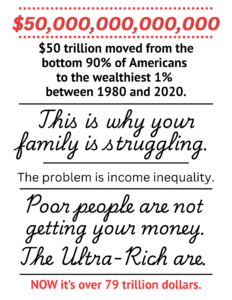

Income: Regular workers have experienced wage stagnation, with real wages barely increasing since 1978, while executive compensation has grown by over 1,000%, far outpacing productivity and stock market gains.

-

Benefits: Regular workers have seen a decline in traditional benefits like defined benefit pensions and employer-sponsored health insurance, with a shift toward less secure defined contribution plans. Higher-level employees, however, continue to enjoy more comprehensive benefits, including access to SERPs, better health insurance, and additional perks.

This divergence reflects broader economic and policy trends that have favored higher-level employees while leaving regular workers with limited income growth and reduced benefits, highlighting the growing income inequality in the U.S. economy.